Medical society unable to rank top local health insurers, saying ‘they all came in last’

Harris County Medical Society released its first “Payor Survey,” in which 487 local health professionals rated the six largest insurance companies in the region on care, payment and customer service. Except, they couldn’t actually rank them because they all came in at “the cellar level”. The insurance companies rated are Aetna, Blue Cross Blue Shield of Texas, Cigna, Humana, UniCare and United Healthcare.

About 500 members of the Harris County Medical Society responded to a survey on the top six health insurers in the Houston area. Some results:

• 70 percent said insurance companies had denied claims for medically necessary procedures.

• 66 percent said they had trouble getting insurance company preauthorization for scans and other imaging.

• 83 percent said the red tape and delayed payments involving insurance companies require them to have at least one employee per doctor to deal with filing and billing issues.

Read the full story here.

I applaud Harris County for its efforts, and for helping to force a dialogue where there previously has been none. In response to their efforts, most Payors have responded one way or another. Cigna cites its improvement in the denial category as evidenced in AthenaHealth’s Payor View rankings (see Physicians Practice article here) and points to its use of physician focus groups as a way of showing engagement with the issues.

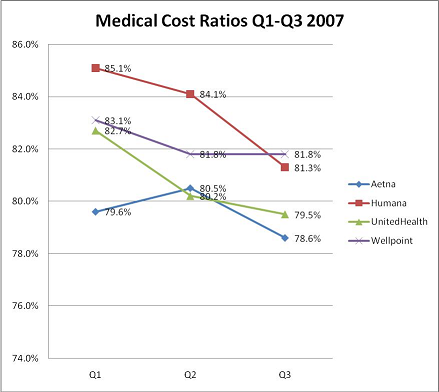

United could take a leaf out of Cigna’s book. The WSJ reported Wednesday that ‘Bad Service Cost UnitedHealth 315,000 Customers’. The CEO, Mr. Hemsley, admits that UHC is the ‘industry’s worst’ at resolving billing issues with providers. While it is refreshing to hear admissions of this nature, where is the game plan for remediation?

Perhaps as more provider-perspective rankings are made available, these issues may finally be adequately confronted. The quarterly Verden report – available late January 2008 – ranks insurers on data generated from the Verden Alert subscription service, which tracks policy and procedure changes issued by 160 companies nationally.

You’ll hear about it here first!