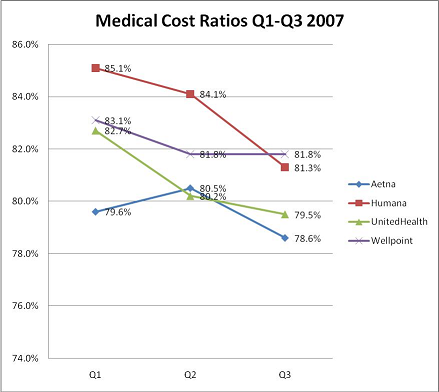

Medical Cost Ratios (or, Big Profits for Insurers)

Insuers’ profit margin comes not only from increasing premiums, but by lowering the amount spent on healthcare. As insurers spend less, their Medical Cost Ratios (MCR) decline. The definition of MCR is simply the amount of money brought in by premiums minus the amount of money spent on reimbursing health care providers.

Insurers reduce what they spend by controlling costs in a number of ways. In its finest form, cost-cutting comes about through efficient operations, negotiating better contracts with such high volume service management companies as labs and diagnostics, and actively promoting well care programs to achieve healthier members. Some of this happens, of course, but there is a growing trend across the board to simply cut reimbursement rates to providers and erode reimbursement through policy and procedure changes. I believe that this is having the biggest impact on the ever-growing profits of publicly traded MCOs this year.

Note – Each incremental percentage point decrease in MCR is worth millions of dollars in savings to these insurers.

Using the figures in the chart, let’s look at UnitedHealthcare to see what those savings might add up to be. Aggregated over three quarters, UnitedHealthcare’s MCR in the chart above adds up to a decline of 3.2%. Based on SEC filings UnitedHealth Group reported premiums totaling $16,984,000,000 for those same three quarters. If we simply calculate what saving 3.2% of those premiums represent, we get a net of $543,488,000. That is, a 3.2% decline in MCR over 9 months translates to more than a half billion dollars in savings to UnitedHealthcare’s bottom line.

Sadly, these ‘savings’ are not being passed along to employers and individuals in the form of lower premiums. Instead, premuims are projected to rise by 7.5% in 2008.

http://www.healthbeatblog.org/2008/02/can-insurers-ad.html